Getting Started With WOTC

What Business Owners Need to Know

Our partner, WOTC.com, provides business owners with the opportunity to profit from their recently hired employees by maximizing the Work Opportunity Tax Credit (WOTC).

Who is eligible?

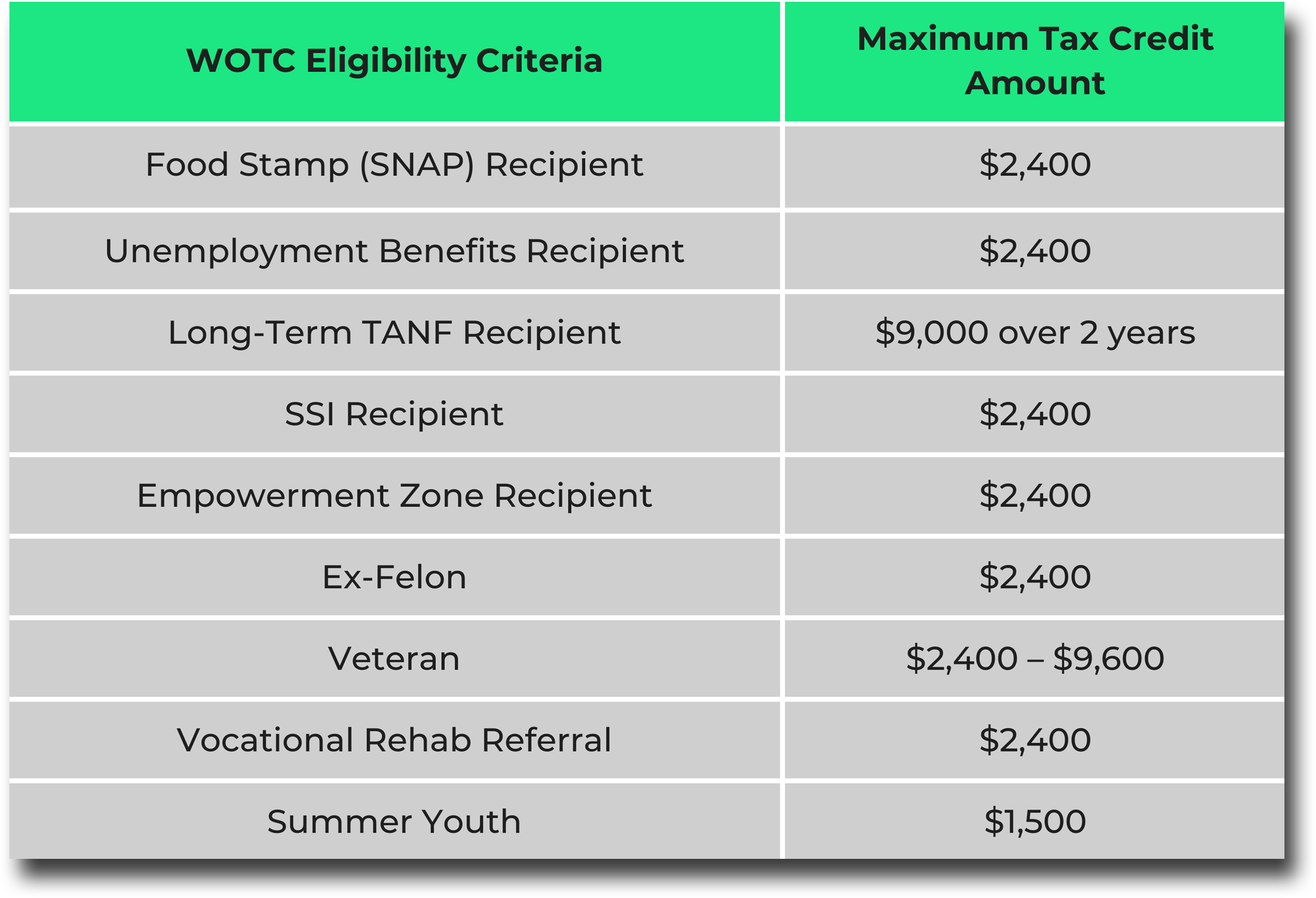

WOTC is a federal tax credit available to private sector businesses, rewarding them for every new hire that meets eligibility requirements. The government program has identified nine target groups that have historically faced significant barriers to employment and offers participating companies between $2,400 – $9,600 per new qualifying hire.

How We Can Help

Our partner is comprised of an advanced team of tax credit professionals with an array of extensive knowledge about claiming credits. This their sole focus, making them experts and leaders in the field.

The WOTC Process:

3 Easy Steps

New Hire Forms

Each new hire or applicant completes an IRS 8850 form

These forms can be completed online at WOTC.com

If desired, paper forms can be emailed, mailed, faxed, or uploaded to WOTC.com.

Forms must be submitted with 28 days of hire.

WOTC.com Accounting Professionals

A WOTC.com team of accounting professionals will review the applications and submit to the state agencies with backup documentation, as needed.

They work hard to get the employees certified and will update the clients with monthly Pre-Qualified Reports.

Your CPA Gets the IRS Forms for Filing

WOTC.com will import your employee's payroll data into their system to compute the actual WOTC Tax Credits.

Payroll data can be submitted to WOTC.com via API Integrations, Annual Payroll Reports, or through our online system.

The completed IRS forms are generated and sent to you and your CPA for filing.

Ready To Get Started?

You could be leaving money on the table simply by not screening candidates properly at onboarding. Let Paymaster help you claim the credits you’re owed seamlessly through payroll integrations.

We Service the Following Areas

(and so many more)